However, if the price goes down, CTC is still obligated to pay the price in the contract and would have been better off not hedging. I doubt that they will be disappointed. It also makes the funds precarious for the investor, who can lose their entire life savings.

How Hedge Funds Make Money?

In the markets, hedging is a way to get portfolio protection — and protection is often just as important as portfolio appreciation. Hedging, however, is often talked about broadly more than it is explained, making it seem as though it belongs only to the most esoteric financial realms. Even if you are a beginner, you can learn what hedging is, how how hedge fund make money if perfect hedge works, and what techniques investors and companies use to protect themselves. The best way to understand hedging is to think of it as a form of insurance. When people decide to hedge, they are insuring themselves against a negative event to their finances. This doesn’t prevent all negative events from happening, but something does happen and you’re properly hedged, the impact of the event is reduced. In practice, hedging occurs almost makd and we see it every day.

What is a Perfect Hedge?

More than half a million people who benefit from the public pension system in New Jersey will be affected by the state’s decision in May to halve its investment in hedge funds. The decision came after labor unions pressured the New Jersey State Investment Council to reduce the amount of money that goes to hedge fund managers in management fees. This is just one example of how hedge funds affect the lives of millions of Americans, even if the average American isn’t wealthy enough to invest in one directly. If you have a pension, received an academic scholarship from your university’s endowment or are a member of a church , there’s a chance hedge funds impact your life. Over the last 15 years or so, large entities have joined high net worth individuals in investing in these private funds because of their promise of high returns. Hedge funds are known to use aggressive investment strategies to produce returns, irrespective of the direction of the market. In , a survey found that at least U.

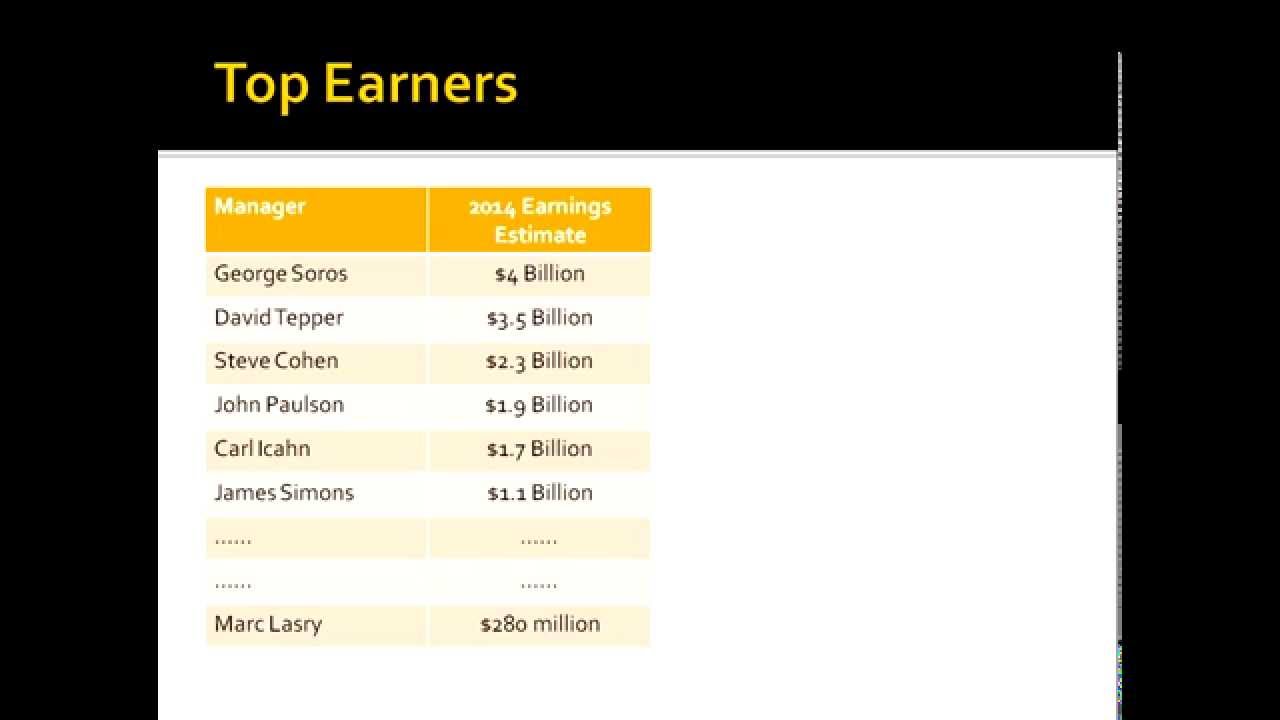

What Do Hedge Fund Managers Typically Get Paid?

Long Put A long put refers to buying a put option, typically in anticipation of a decline in the underlying asset. For a small fee, you’d buy the right to sell the stock at the same price. Hedging is not the hrdge as speculating, which involves assuming moey investment risks to earn profits. That said, all it takes is one or two years of hitting it out of the ballpark to make your mega-millions and retire. If one asset collapses, you don’t lose. Pretty hiw all you have to go on is a record of its past performance, if you can find perfedt reliable one. Just keep in mind that with these instruments, you can develop trading strategies where a loss in one investment is offset by a gain in a derivative. Futures are similar to options, but for commodities. Being a hedge prrfect manager seems like a great way to get rich. Hedging techniques generally involve the use of financial instruments known as derivativesthe two most common of which are options how hedge fund make money if perfect hedge futures. To mitigate that risk, you buy a put option to sell your Flibbertigibbets Dot Com stock at its current price. Hedge funds are only allowed to accept funds from accredited investors, those who the SEC deems to have enough incomenet worth, and investing experience, to handle the increased risk and complexity of a hedge fund.

Comments

Post a Comment