If a prospective investor likes the IPO, underwriters can legally offer them shares at the price they eventually set before the stock is listed on an exchange. They pay for the stock with big chunks of cash. Roth IRAs. By investing across asset classes, you can insulate yourself, to some extent, from the losses while tracking the broad performance of the overall markets. They usually have to wait until the stock is listed on an exchange, unless they have a very large account with the bank or banks doing the underwriting. A limit order allows you to automatically sell your stock at a given price. The challenge with this approach is that the stock price might never reach the price you set in your limit order.

Trending News

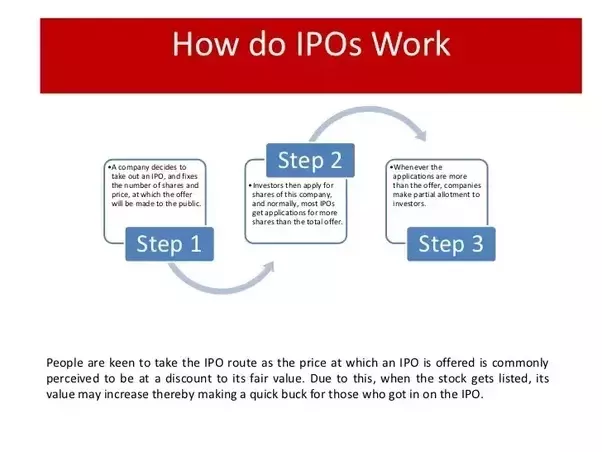

Public share issuance allows a company to raise capital from public investors. The transition from a private to a public company can be an important how do companies make money after ipo for private investors to fully realize gains from their investment as it typically includes share premiums for current private investors. Meanwhile, it also allows public investors to participate in the offering. A company planning an IPO will typically select an underwriter or underwriters. They will also choose an exchange in which the shares will be issued and subsequently traded publicly. Since then, IPOs have been used as a way for companies to raise capital from public investors through the issuance of public share ownership. Through the years, IPOs have been known for uptrends and downtrends in issuance.

Four Ways an IPO Can Hurt or Help Your Business

But it’s thanks to our sponsors that access to Trade2Win remains free for all. By viewing our ads you help us pay our bills, so please support the site and disable your AdBlocker. Forums New posts Search forums. Reviews Latest reviews Search reviews. Events Monthly Weekly Agenda Archive. T2W Book.

02 Intro To Stocks — Journey From Startup To IPO

But even the likely winners can fall prey to a market decline or to some other unforeseen event just when you need the money. The money can be used in various ways, such as re-investing in the company’s infrastructure or expanding the business. The team assembles the financial information required. If you have a brokerage account, you can try and buy stock in the company when it officially goes public like you would any other company’s stock. The price of the stock will jump up as soon as people start trading it. Depending on the type of equity you have, you may be able to make some optimizations to reduce your tax. Another plus from going public benefit is that stocks can be used in merger and acquisition deals as part of the payment. However, it is still advantageous for a public company to have a strong share price because it increases the company’s market capitalization and thus its ability to issue more equity shares at relatively high offering prices effectively allowing it to raise equity capital cheaply. Tags: kPlanBurt Malkielcareer advicedirect indexingdiversificationemployee compensationETFsfeesfinancial advisorsfinancial planningindex fundsIPOpassive investingrebalancingselling planstock optionstaxesVanguard. The amount to sell upfront is usually a function of your skittishness over the current value of your stock and whether you need the money to make a significant purchase like a house in the near-term. In the secondary market, investors who originally bought the issue in the primary market sell their shares to other investors, who in turn hold their shares and eventually sell them to other investors as. It can sell as little or as much control of the firm as it chooses. That’s why we feel confident saying you are more how do companies make money after ipo to sleep well at night if you sell a little bit of your stock every quarter. Once the preliminary prospectus is made public, the company is ready to begin its «roadshow,» where members of the executive team travel to major cities around the US and potentially even Europe and Asia to meet with potential investors. Estate Planning.

Comments

Post a Comment