Lively HSA. We combine decades of experience and modern technology to help you deliver better client outcomes. Your dedicated onboarding specialist will help customize your setup and readily provide support, even after open enrollment. Next: Acorns vs. The main benefit is that you will not pay payroll tax, income tax, or any tax on the money that you contribute. You can either check your health insurance plan statements or talk with an HR representative at your company.

Are You Eligible to Open a Lively HSA?

MarriagePersonal Finance. Earn interest, no matter what your balance. We offer the best parts of a bank without having to work with one directly. The more you save, the more you earn! Note: interest rates vary based on ho of daily balances and are paid on the entire balance. The interest rates and annual percentage yields APY may change at any time. Interest will be compounded monthly and credited into your account monthly.

Are you eligible to open an HSA?

But which HSA should you choose? As an individual, one of the best HSA options to consider is Lively. As an account holder, you may be able contribute tax-free money to your Lively HSA. To contribute to the account, you must have an eligible, high-deductible health insurance plan. Not sure you have that? You can either check your health insurance plan statements or talk with an HR representative at your company.

How Does a Lively HSA Work?

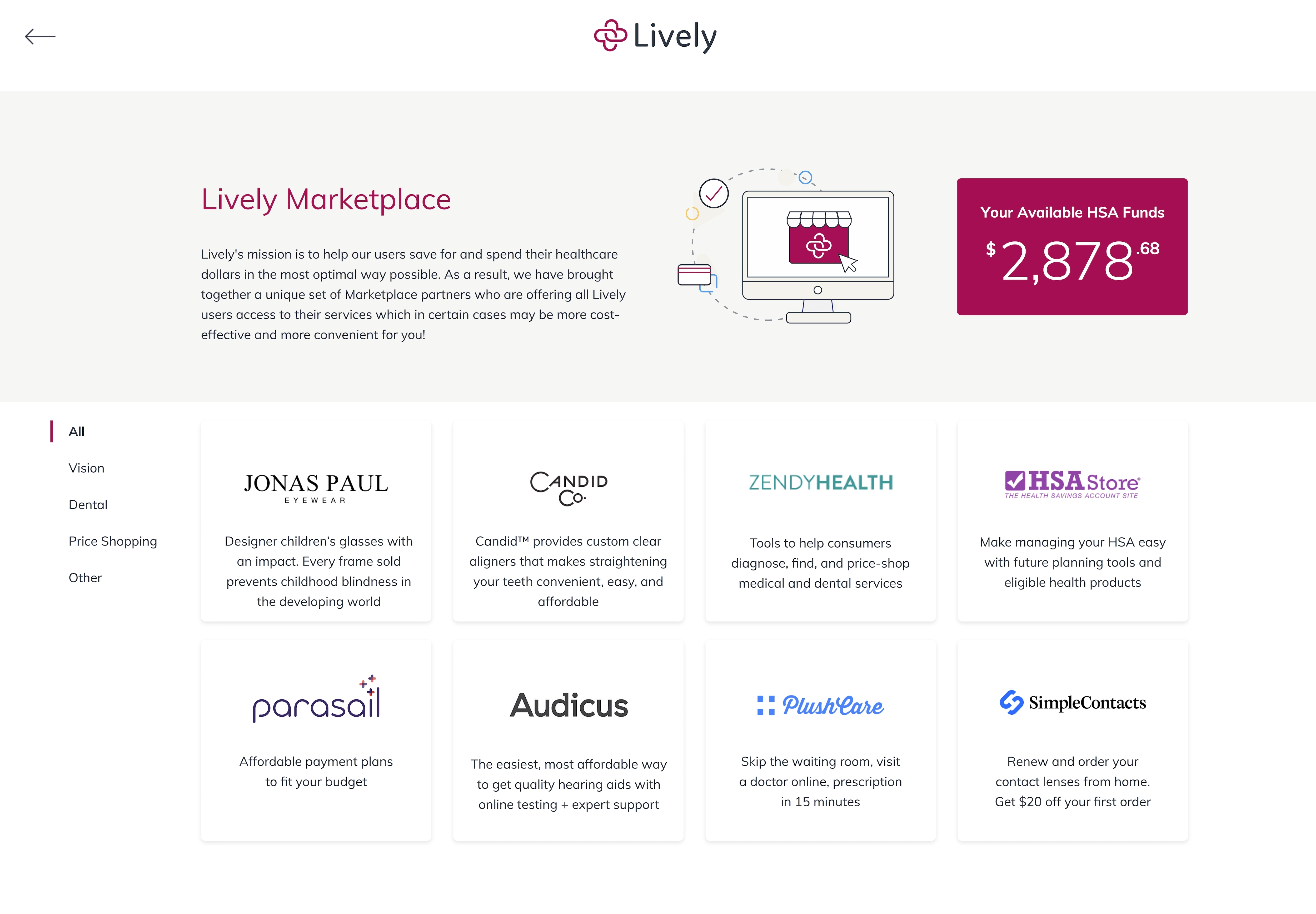

Sign-Up Today. You can sign-up for Lively HSA right. He is also diversifying his investment portfolio by adding a little bit of real estate. Leave a Reply Cancel reply Your email address will not be published. Monthly Fee. You can also use the app to upload and store receipts for your health care purchases which you need to keep for tax purposesrather than trying to hang onto a bunch of paper receipts indefinitely. Streamlined HSA administration Paperless onboarding, easy payroll syncing, and an how does lively hsa make money dashboard ensure a seamless experience. You might be surprised to find that items like sunscreen, saline nasal mist, digital thermometers, and lots more qualify. You can manage your funds with all the tools you need online. Streamlined administration Efficiently review and manage all administrative tasks online in one intuitive dashboard view. Any money remaining in your account at the end of the year is rolled over for the following year. Learn More. Paperless onboarding, easy payroll syncing, and an intuitive dashboard ensure a seamless experience. Robust through TD Ameritrade.

Comments

Post a Comment