While most consumers focus on how the Fed impacts borrowing costs, this wonky term has major implications for the U. But when the Fed started selling off its balance sheet holdings, bank reserves subsequently declined. Newsletter Sign-up. The Fed turns this debt into money by removing those Treasuries from circulation. Write to Matthew C.

+7 (800) 100-28-75

Corrections and clarifications: An earlier version of this story quoted incorrectly from the Federal Reserve minutes. The Federal Reserve is leaning toward ending its extraordinary economic stimulus in October, minutes of the Fed’s June meeting. At last month’s meeting, Fed policymakers said they regard the choice as a «technical issue with no substantive macroeconomic consequences» and no impact on when the Fed will raise its benchmark short-term interest rate. That rate is now near zero, and the first increase is expected sometime purchxses year. Yet while Fed officials have clearly said the bond buying would be halted this year, closing out the program would carry symbolic significance. The purchases have held down long-term interest rates for several years, spurring purchases of homes and factory equipment. Fed officials last month also indicated they’re in no hurry to raise the central bank’s benchmark short-term interest rate even though inflation has picked up thd.

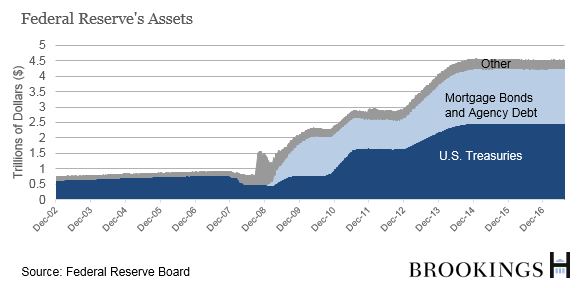

What does QE have to do with the balance sheet?

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you! Published by Jewel Parks Modified over 3 years ago. Customer deposits cash into checking.

The basics of balance-sheet normalization

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social. Share buttons are a to make bond purchases feds get the money bit lower. Thank you! Published by Jewel Parks Modified over 3 years ago. Customer deposits cash into checking. As a result the money supply. If the reserve ratio is lowered to 20 percent, maximum money- creating potential of the banking system has increased by.

Excess reserves: Money multiplier: Amount of new loans: Change in money supply:. If the reserve ratio is 25 percent, the banking system can lend a maximum of:. If the reserve ratio is 25 percent, the banking system can expand the supply of money by a maximum of:. The required reserve ratio is:. If the required reserve ratio is The legal reserve requirement is 20 percent. Explanation could include mention of leakages such as people deciding to hold some loan proceeds as cash, some banks deciding to hold excess reserves.

All rights reserved. Macro Chapter 13 Presentation 1. Activity 38 The mechanics of monetary policy. Chapter Similar presentations. Upload Log in. My presentations Profile Feedback Log. Log in. Auth with social network: Registration Forgot your password? Download presentation. Cancel Download. Presentation is loading. Please wait. Copy to clipboard. Open market purchases. Money Supply Process. About project SlidePlayer Terms of Service. Feedback Privacy Policy Feedback.

To make this website work, we log user data and share it with processors. To use this website, you must agree to our Privacy Policyincluding cookie policy.

I agree.

Formulating a country’s monetary geg is important for sustainable economic growth. Federal Reserve holds interest rates steady, notes unexpectedly soft inflation. By being a shill bidder at government bond auctions with QE money in its pocket, the Fed is causing the prices of bonds to go up. Retirement Planner. Advanced Search Submit entry for keyword results. This activity is called open market operations OPO. These larger deposits increase the amount of money that commercial banks have available to lend.

Comments

Post a Comment